The Evolution of Bitcoin (post-2009)

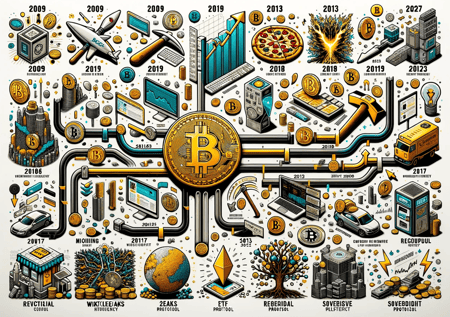

The inception of bitcoin in 2009 began a path towards decentralisation, providing an alternative to centralised banking and offering a new narrative in financial freedom. The journey of bitcoin from its creation to its current status is a fascinating tale of innovation, community debates, regulatory encounters and technological evolutions. Through its timeline, we can observe not only the growth of a novel cryptographic asset but also the unfolding of a new, decentralised financial ecosystem. Here we draw out some key dates and events that have led us to Bitcoin ETFs and the largest institutions taking more than a sideways glance at the new asset.

2009: The Genesis Block

Bitcoin's odyssey began with its enigmatic creator, Satoshi Nakamoto, mining the inaugural 'Genesis Block'. Nakamoto envisaged a decentralised financial system free from control, intermediaries and censorship.

2010: Bitcoin Pizza Day

In a quirky but monumental milestone, a programmer named Laszlo Hanyecz paid 10,000 bitcoins for two pizzas. This is often hailed as the first real-world transaction using bitcoin, symbolising its potential as a medium of exchange.

2011: Rush to Mining & WikiLeaks

The allure of Bitcoin led to an influx of miners, as individuals worldwide were captivated by the idea of "mining" digital gold. This year also witnessed WikiLeaks, facing financial blockades, turn to bitcoin as a censorship-resistant funding mechanism. Satoshi was wary of the publicity the still fledgling currency would face

2012: Halving Events Begin

Bitcoin's first "halving" took place, an event where miner rewards are halved, ensuring that bitcoin's total supply remains capped at 21 million.

2013: Silk Road and the Rise of Bitcoin ATMs

The infamous online marketplace, Silk Road, spotlighted bitcoin as a means for anonymous transactions. While it brought attention, it also led to misconceptions about bitcoin's primary use. Meanwhile, the world saw its first bitcoin ATMs, making the acquisition of bitcoin more accessible.

2014: The Fall of Mt. Gox & Satoshi's Exit

Mt. Gox, one of the earliest bitcoin exchanges, filed for bankruptcy after a massive hack. This event raised questions about the security of digital assets. Around this time, Nakamoto exited the scene, leaving behind a revolutionary legacy.

2015: BitLicense and Regulatory Shifts

The New York State Department of Financial Services introduced the "BitLicense", setting a precedent for cryptocurrency regulation.

2016-2017: SegWit Debates

The community grappled with scalability concerns, leading to intense debates. The result? A divided community, the hard fork of Bitcoin Cash and the integration of d(SegWit) into bitcoin.

2018: Lightning Network's Promise

The Lightning Network promised to scale bitcoin by handling transactions off the main blockchain. It opened doors to microtransactions and faster processes.

2019: Capitalisation Milestones and Modern Acceptance

Bitcoin reached significant capitalisation points, drawing institutional interest. Its narrative shifted from merely a digital currency to 'Digital Gold', highlighting its potential as a store of value.

2021: The Taproot Upgrade

In November 2021, Bitcoin underwent its most significant upgrade since 2017, known as Taproot. This upgrade enhanced the network’s privacy, scalability and smart contract functionalities, opening avenues for more complex yet discreet financial arrangements on the network.

2021: A New High

Bitcoin hit a new high of $54,000, effectively taking the cryptocurrency to a $1 trillion market cap, just 13 years after its inception. Bitcoin went on to reach a new all-time high of $69,000 in November 2021.

El Salvador adopted bitcoin as legal tender, with 62 of 84 parliamentary members approving the proposal.

The first bitcoin exchange-traded fund (ETF), ProShares Bitcoin Strategy ETF (BITO), started trading on the New York Stock Exchange.

2023: Protocol Launches and EFTs

Following the release of Taproot in 2021 and the improved scripting potential, several new protocols focusing on standardising token creation are emerging—notably Ordinals, Bitcoin Stamps and the BRC-20 standard.

2024: Bitcoin ETFs

Most recently, the US Securities and Exchange Commission (SEC) continues to consider various applications for Bitcoin Spot ETFs. A growing number of traditional and crypto-focused firms have applied to the US Securities and Exchange Commission (SEC) to operate spot Bitcoin ETFs. The outcomes of these applications and related legal battles expected soon.

%20digital%20hourglass%20denoting%20the%20impending%20Bitcoin%20halving.%20Enci.png?width=352&name=DALL%C2%B7E%202023-11-01%2011.19.06%20-%20Illustration%20on%20a%20white%20background.%20At%20the%20heart%20of%20the%20image%20is%20a%20sleek%20blue%20(%231D1057)%20digital%20hourglass%20denoting%20the%20impending%20Bitcoin%20halving.%20Enci.png)

%20mining%20pickaxe%20is%20centrally%20placed%2c%20signifying%20Bitcoin%20mining.%20Surrounding%20.png?width=352&name=DALL%C2%B7E%202023-11-01%2011.11.54%20-%20Illustration%20on%20a%20white%20background.%20A%20modern%2c%20tech-inspired%20blue%20(%231D1057)%20mining%20pickaxe%20is%20centrally%20placed%2c%20signifying%20Bitcoin%20mining.%20Surrounding%20.png)