Is Bitcoin’s Distribution Fair?

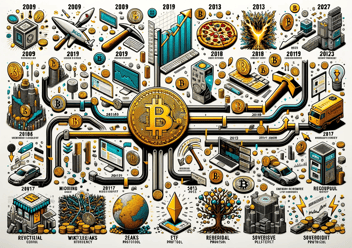

Since its inception in 2009, bitcoin has been heralded as a decentralised, borderless and egalitarian form of money, promoting a narrative of financial inclusivity. The core ethos of bitcoin is rooted in creating a fair financial system devoid of centralised control. However, discussions surrounding the actual fairness of bitcoin, particularly in terms of ownership distribution, often come to the fore.

Bitcoin: A Genesis of Egalitarian Financial System

Born during the aftermath of the 2008 financial crisis, bitcoin was heralded by some as a beacon of financial egalitarianism. It aimed to level the financial playing field, devoid of intermediaries and open to anyone. Bitcoin's protocol ensures a transparent, predictable issuance rate, providing a platform that is verifiable and participatory for anyone with internet access. Bitcoin was conceptualised to counter the centralised control over financial systems, a principle that remains integral to its protocol.

Scrutinising Bitcoin Ownership Distribution

Critics often point out a seemingly skewed ownership distribution in bitcoin, where a significant portion is held by a small percentage of entities. However, the narrative of ownership distribution is more complex than it appears. Large addresses may represent custodial wallets holding bitcoin for multiple individuals, while some individuals may diversify their holdings across numerous addresses. The transparent nature of Bitcoin’s blockchain allows for scrutinising its ownership distribution, albeit the pseudonymous aspect can obscure precise ownership dynamics.

https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html

Comparing Centralisation Dichotomy

The discussions surrounding bitcoin's fairness often intersect with the wealth distribution reality of existing financial systems. While bitcoin's protocol is impartial, the early adopters predominantly were technically savvy individuals who recognised its potential. This trend, though, doesn’t stem from systemic bias but rather from the nature of technological adoption. Bitcoin doesn’t discriminate based on wealth, status or geographical location.

Bitcoin and Financial Inclusivity

Bitcoin, with its open-access and decentralised ethos, purportedly lays the groundwork for financial inclusivity. The lack of intermediaries and censorship-resistant nature positions bitcoin as a potent tool against financial discrimination. Moreover, the ongoing efforts to simplify bitcoin’s user interface and enhance accessibility are promising strides towards enabling a broader demographic to partake in this financial innovation.

Key SEO Words: Bitcoin, Ownership Distribution, Financial Inclusivity, Decentralised, Satoshi Nakamoto, Peer-to-peer electronic cash system, Bitcoin Protocol, Blockchain, Centralization, Financial Discrimination, Egalitarian Financial System, Censorship-resistant, Financial Innovation, Financial Transparency, Individual Empowerment.