What is decentralised finance (DeFi)?

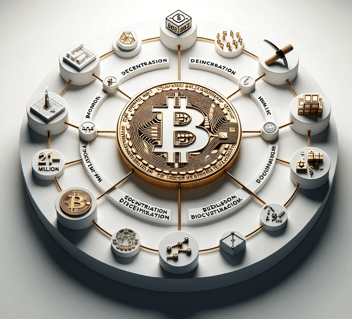

Decentralised finance is a broad term to describe a variety of financial applications that are built on a blockchain. They are considered ‘money legos’, the concept that protocols, smart contracts and DeFi apps - or dApps - can be snapped together and built on top of one another.

.png?width=450&height=450&name=What%20is%20decentralised%20finance%20(DeFi).png)

DeFi is a relatively new phenomenon in the cryptocurrency world as it aims to replace or disseminate existing intermediaries required in providing services such as borrowing and lending, exchanges, investing, and management. It has expanded blockchain’s use from transferring value to providing complex financial products.

Some consider the crypto ecosystem to be the Wild West of finance, and if that were the case, DeFi could be viewed as a series of gold or oil rushes. They quickly created communities, vast adoption and a sense of euphoria before receding once it was found the vein of gold wasn’t as rich as had once been promised.

Early projects began in 2015 with the release of Ethereum, which made building applications vastly easier. The period from 2019 - 2021 was termed the ‘DeFi Summer’, where there was a fervour as users rushed to different protocols that offered the best rates, and the total value of assets locked in DeFi services peaked at $177 billion in late 2021, before falling back to under $40 billion a year later. DeFi products offered some of the highest returns but also the heaviest losses.

New terminology has emerged due to the rise of DeFi, such as yield-farming, liquidity mining, composability, primitives and impermanent loss. Head-scratching concepts that make even crypto-veterans feel like a newbie again!

It was several DeFi exploits and failings, such as the collapse of Terra’s algorithmic (un)stablecoin UST that signalled the end of Defi Summer and the 2019-2021 crypto bull run. In 2022 alone, a reported $3.1 billion was lost due to DeFi hacks, accounting for 82.1% of all stolen cryptocurrency that year.

DeFi remains shrouded in mystery to outsiders but proponents are positive about the huge impact it will have on creating a decentralised economy.