Bitcoin’s Scalability Dilemma and Solutions

As Bitcoin garnered acceptance and a growing user base, a notable concern emerged: scalability. The block size limit and the interval between blocks, while initially engineered to ensure security and maintain decentralisation, have imposed a limit on the number of transactions the network can process. This predicament, often known as the scalability issue, brings solutions that purport to strike a balance between efficiency, security and decentralisation.

Understanding the Scalability Quandary

The crux of Bitcoin's scalability dilemma lies in its design - a 1MB block size limit and a 10-minute block interval, deemed sufficient in its nascent stage. However, as Bitcoin's popularity increased, these parameters started showing their limitations. The blockchain began experiencing congestion, leading to slower transaction times and higher fees. This scenario is a testament to the pressing need for scalable solutions to accommodate a growing user base without undermining Bitcoin’s core principles.

The broader cryptocurrency community has a vested interest in overcoming this hurdle as it affects not only the utility and efficiency of Bitcoin but also its potential mainstream acceptance. The essence of solving the scalability issue is to increase the transaction throughput capacity of the network. Various propositions, both on-chain and off-chain, have emerged over the years, striving to alleviate this bottleneck while upholding the principles that Bitcoin embodies.

The SegWit Proposition

Segregated Witness, or SegWit, emerged as a landmark proposal aimed at tackling Bitcoin’s scalability challenge. By separating the transaction signatures from the transaction data, SegWit creates more room in a block. This separation not only augments the block capacity but also addresses a long-standing issue known as transaction malleability, which has been a hurdle to further scalability solutions.

Post its activation in 2017, SegWit also laid the groundwork for the implementation of second-layer solutions like the Lightning Network and protocol upgrades such as Taproot, heralding a new era of scalable and efficient transaction processing on the Bitcoin network.

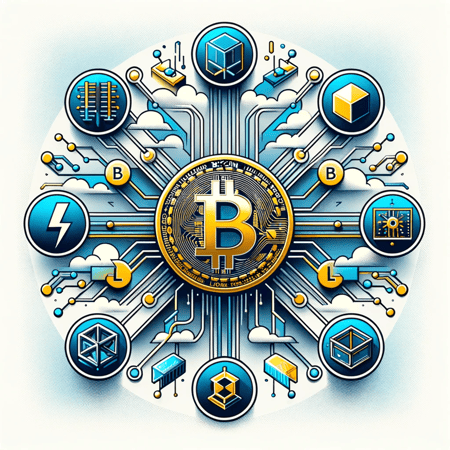

Layer 2 Solutions: Lightning Network

The Lightning Network operates as a second layer atop the Bitcoin blockchain. It envisages a network of off-chain payment channels that facilitate quick, low-cost transactions. By allowing users to transact off the main blockchain, it significantly reduces the load on the network, addressing the bottleneck of transaction processing capacity to a considerable extent.

The inception of the Lightning Network has been a significant milestone in Bitcoin’s journey toward scalability. By enabling a higher transaction throughput while maintaining low fees, it opens up possibilities for micro-transactions and real-time or ‘streaming’ payment solutions on the Bitcoin network.

Block Size and Block Time Adjustments

A straightforward approach to enhancing Bitcoin's scalability is increasing the block size or reducing the time interval between blocks. These fundamental parameters could provide temporary respite from network congestion, allowing more transactions to be processed within a given timeframe.

However, such adjustments come with significant trade-offs. A larger block size could lead to centralisation as only miners with substantial computational resources could participate in the network. Similarly, reducing the block time could compromise the security of the network. These considerations accentuate the need for a cautious and well-thought-out approach to modifying the inherent parameters of the Bitcoin blockchain. It was this debate that caused a group to hard-fork Bitcoin and create Bitcoin Cash in 2017.

Taproot Upgrade

Activated in November 2021, Taproot is deemed to be the most substantial upgrade to the Bitcoin network since the activation of SegWit in 2017. It brings forth a blend of enhanced privacy, efficiency and flexibility, further nudging Bitcoin towards solving the scalability predicament.

At its core, Taproot enhances the scripting capabilities of the Bitcoin network, allowing for more complex smart contract functionality. It amalgamates the Schnorr signature scheme with Merkleized Alternative Script Trees (MAST) and a new scripting language called Tapscript. This ensemble of features facilitates more compact, private and flexible transactions.

By facilitating more complex transactions with lesser data and improved privacy, Taproot addresses some of the inefficiencies that have clogged the Bitcoin network in the past. Moreover, it provides a conducive environment for smart contract development, opening doors to a plethora of financial applications that could operate on the Bitcoin blockchain.

On-chain and Off-chain Scalability

On-chain scalability solutions focus on modifying the existing blockchain parameters or implementing new protocols on the current chain to accommodate higher transaction volumes. These solutions often come with the caveat of requiring network consensus, making them relatively challenging to implement. However, successful on-chain solutions can provide a direct alleviation of the scalability issues facing the network.

Off-chain solutions, on the other hand, look toward external frameworks to process transactions outside the main blockchain. These solutions can provide immediate relief from network congestion without requiring consensus from the network participants.

Sharding

Sharding is a concept often associated with alternative blockchain networks. It involves partitioning the blockchain into smaller shards, each capable of processing transactions independently. With sharding, full nodes no longer have to store or process the entirety of the network's activities. This mechanism drastically improves the transaction processing capacity of a network, showcasing a significant leap toward enhanced throughput.

Though sharding is more prevalent in other blockchain ecosystems, the underlying principle evokes some discussion within the Bitcoin community. However, due to the nature of Bitcoin nodes storing the entire history of transactions, which sharding would remove, it is a highly unlikely, albeit still possible, scaling solution.

The solutions outlined and implemented thus far underscore the blockchain community's commitment to nurturing Bitcoin’s scalability without compromising its foundational principles. As an open-source project, anyone can view or propose changes to the protocol from anywhere. Groups of developers make and work on proposals that can make improvements in some areas; collectively, a combination of solutions could come together to improve the scalability of Bitcoin, much like how Bitcoin is a combination of 40 years of research, proposals and failed experiments before it.